Bank of america private banking

Author: s | 2025-04-24

Bank of America Private Bank, Bank of America Private Wealth Management operates through Bank of America, N.A, and other subsidiaries of Bank of America Bank of America Private Bank. If you have over $3 million in investable assets, Bank of America Private Bank is another great option to consider. Bank of America offers exclusive products for its private banking

Bank of America Private Bank Named Best Private Bank in North America

Group Editor February 18, 2025 The move represents a number of developments across BoA's wealth management and private banking arm in recent months. Bank of America Private Bank has appointed Mike Marino as Georgia market executive. Previously, he worked at JP Morgan Private Bank, where he was vice chairman of its South Atlantic region. Marino is on garden leave and will join BoA in late April, this publication understands. In total, Marino has more than three decades’ industry experience, working in private banking and investment banking. He holds a BA from Vanderbilt University and an MBA from Emory University. Marino has held leadership positions for educational organizations including the Emory University Advisory Board, finance committee chair for Atlanta Speech School, and The Posse Foundation Board. Marino serves as a board member for the Capital City Club as well as the Purpose Built Communities organization. See here for the latest financial results at Bank of America. In January, BoA's Merrill Wealth Management launched its new UHNW Advisory Group. In November, Bank of America Private Bank added a team of former Citi Private Bank figures in Palm Beach, Florida. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset allocation, rebalancing and diversification do not guarantee against risk in broadly declining markets.Neither Bank of America Private Bank nor any of its affiliates or advisors provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.Credit and collateral subject to approval. Terms and conditions apply. Programs, rates, terms and conditions subject to change without notice.Trust, fiduciary and investment management services, including assets managed by the Specialty Asset Management team, are provided by Bank of America, N.A., Member FDIC and wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”), and its agents.Bank of America Private Bank is a division of Bank of America, N.A.U.S. Trust Company of Delaware is a wholly owned subsidiary of Bank of America Corporation.p>Investment products:Are Not FDIC Insured Are Not Bank Guaranteed May Lose ValueBank of America, N.A., and U.S. Trust Company of Delaware (collectively the “Bank”) do not serve in a fiduciary capacity with respect to all products or services. Fiduciary standards or fiduciary duties do not apply, for example, when the Bank is offering or providing credit solutions, banking, custody or brokerage products/services or referrals to other affiliates of the Bank.Bank of America credit cards - Bank of America Private Bank

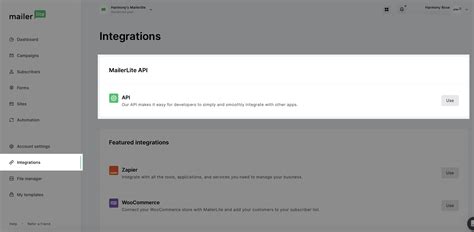

Share in account privilegesSuccession: UnlimitedPrivate foundation offering: Foundation management services6Client type: May be ideal for philanthropists who prioritize flexibility and controlTax preparation: Available to foundations provided our firm manages all assetsAdministration: Broad range of administrative services availableAccount minimums: Greater than $5 million is recommended, with no strict minimumsAssets accepted:CashSecurities and mutual fundsRestricted stock and closely held business interests4Hedge funds and private equity interest4Real estate, timberland, farms and ranches4Gas, oil and mineral rights4Certain other nonfinancial tangible assets4Other complex assets4Support from grantmaking professionals: Comprehensive support including strategic planning, grantmaking and administrative services, mission development, governance and compliance5Family involvement: Family members and other trusted advisors may be involved in roles such as trustee, director or advisorSuccession: UnlimitedFor donor-advised fund questions contact the Charitable Gift Fund at 888-703-3436 or email us at [email protected] private foundation questions or general philanthropic solution inquiries, email us at [email protected]. Learn more about strategic philanthropy & grantmaking Explore more insights 1 This limitation was increased from 50% to 60% for years 2018 through 2025, if all gifts are made in cash. It is scheduled to “sunset” and return to 50% in 2026. 2 Fair market value deductions generally subject to one-year holding period.3 Income received from investment assets (before taxes) such as bonds, stocks, mutual funds, loans and other investments (less related expenses). 4 Please note: additional fees may apply to taking in and managing these assets.5 Custom philanthropic strategy services are available for giving vehicle accounts > $10MM and/or households with investment assets > $25MM.6 Additional fees may apply to some of these services.Donor-advised fund and private foundation management are provided by Bank of America Private Bank, a division of Bank of America N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation.Institutional Investments & Philanthropic Solutions (also referred to as “Philanthropic Solutions” or “II&PS”) is part of Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Trust, fiduciary, and investment management services are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A.. Bank of America Private Bank, Bank of America Private Wealth Management operates through Bank of America, N.A, and other subsidiaries of Bank of America Bank of America Private Bank. If you have over $3 million in investable assets, Bank of America Private Bank is another great option to consider. Bank of America offers exclusive products for its private bankingPrivate Bank Digital Capabilities - Bank of America Private Bank

Transactions More Private?If privacy is a concern for you, there are ways to be more discreet about your transactions. These aren’t perfect solutions, but they might help you feel a little more secure about your financial privacy.1. Use a Separate Account or Prepaid CardOne common recommendation is to use a separate bank account or even a prepaid debit card for OnlyFans transactions. If you’re a subscriber, this is particularly useful because you can keep these transactions away from your main banking activities. Prepaid cards, often found at local retail stores, can be loaded with a specific amount of money and used for OnlyFans purchases.Not only does this help keep your main account private, but it also adds an extra layer of security in case your OnlyFans account is compromised.2. Look for Banks with Private Banking OptionsAnother option for those who want extra privacy is to use banks that offer private banking services. Private banking might sound exclusive, but some banks offer variations of this that include enhanced privacy features. This means that transaction histories can sometimes be issued as internal memos that do not disclose specific vendors like OnlyFans.Some major banks that offer these features include JPMorgan Chase, Bank of America, and Wells Fargo. This could be an excellent option if you’re a content creator who wants to keep OnlyFans-related income discreet.3. Digital WalletsDigital wallets like PayPal are often an alternative method to make online transactions more discreet, but it’s important to note that OnlyFans does not directly support payments through PayPal at this time. However, some users opt for other payment intermediaries to make purchases indirectly. Keep in mind, this requires a few additional steps and may not always work seamlessly.User Experiences: How Others Have Dealt with ThisIf you’ve searched forums or community pages like Reddit or What to Credit Cards Activating Your Credit Card Activate Your Credit Card Activating your credit card online is quick, easy and secure. We'll confirm your identity, verify your card and get you on your way. Activate your Bank of America credit card online The quickest way to activate your personal credit card is with your Online Banking ID and Passcode. We'll confirm your identity, verify your card and get you on your way. If you don't use Online Banking yet, simply enroll to activate your credit card. Already using Online Banking? Sign in and save time. If you're already using Online Banking, simply sign in using your Online Banking ID and Passcode to speed up the activation process. Sign in to Online Banking Not yet enrolled in Online Banking? Enroll now, then activate your card. If you're not currently enrolled in Online Banking, you can easily enroll, activate your card and conveniently manage your banking online. Enroll in Online Banking © 2024 Bank of America Corporation. All rights reserved. Bank of America, N.A. Member FDIC. Welcome to Online Banking, brought to you by Bank of America and Save time managing your finances, so you can spend more time living your life: View your statements online Receive Alerts on your account via email or mobile device Pay your credit card bill online Check your balance and account activity from your laptop or mobile device Welcome to Online Banking from Bank of America and . As an Online & Mobile Banking customer, you can:Private Bank Online and Mobile - Bank of America Private Bank

Loans & Lines of Credit">Term Loans & Lines of Credit Banking Private Client Private Client Elite Checking">Private Client Elite Checking Banking Private Client Private Client Money Market">Private Client Money Market Banking Treasury Management ACH Services">ACH Services Banking Treasury Management Positive Pay">Positive Pay Banking Treasury Management Remote Deposit Capture">Remote Deposit Capture Banking Treasury Management Domestic Wires">Domestic Wires Banking Treasury Management PayRecs International Payments">PayRecs International Payments Banking Treasury Management ZEscrow">ZEscrow Banking Treasury Management ZRent">ZRent Banking Treasury Management Merchant Services">Merchant Services Banking Government Banking ACH Services">ACH Services Banking Government Banking Merchant Services">Merchant Services Banking Government Banking Positive Pay">Positive Pay Banking Government Banking Remote Deposit Capture">Remote Deposit Capture Banking Women In Business Kearny Bank ChangeMakers Checking">Kearny Bank ChangeMakers Checking Banking Women In Business Local Events">Local Events Banking Women In Business Kearny Bank ChangeMakers Blog">Kearny Bank ChangeMakers Blog Client"> Client View Private Client Services">View Private Client Services Client Investment Services">Investment Services Client View Private Client Services Private Client Elite Checking">Private Client Elite Checking Client View Private Client Services Private Client Money Market">Private Client Money Market Solutions"> Solutions Personal Lending">Personal Lending Solutions Business Loans & Lines of Credit">Business Loans & Lines of Credit Solutions Commercial Real Estate & Contruction">Commercial Real Estate & Contruction Solutions Personal Lending Mortgages">Mortgages Solutions Personal Lending Home Equity Loans & Lines">Home Equity Loans & Lines Solutions Personal Lending Home Loans FAQ">Home Loans FAQ Solutions Personal Lending Meet Our Mortgage Advisors">Meet Our Mortgage Advisors Solutions Personal Lending Mortgage Rates">Mortgage Rates Solutions Personal Lending Mortgage Refinancing">Mortgage Refinancing "> Services"> Banking"> Banking Personal Digital Banking">Personal Digital Banking Banking Business Digital Banking">Business Digital Banking Banking Personal Digital Banking Online Banking & Bill Pay">Online Banking & Bill Pay Banking Personal Digital Banking Mobile Banking">Mobile Banking Banking Personal Digital Banking Zelle®">Zelle® Banking Personal Digital Banking Digital Wallet">Digital Wallet Banking Personal Digital Banking Personal Banking Tutorial Videos">Personal Banking Tutorial Videos Banking Business Digital Banking Online Banking & Bill Pay">Online Banking & Bill Pay Banking Business Digital Banking Mobile Banking">Mobile Banking Banking Business Digital Banking Zelle® For Your Business">Zelle® For Your Business Banking Business Digital Banking CardValet">CardValet Banking Business Digital Banking Digital Wallet">Digital Wallet Banking Business Digital Banking Business Banking Tutorial Videos">Business Banking Tutorial Videos About Kearny Bank KearnyBank Foundation Testimonials Investor Relations Investment Services Celebrating 140 Years Personal Rates Home Loans Rates Financial Education Personal Banking Tutorial Videos Business Banking Tutorial Videos Financial Calculators ClickSWITCH Kearny Bank Services Abandoned or Unclaimed Property FAQs Bank Holidays PERSONAL & BUSINESS BANKINGBank of America Private Bank - Login

Responsible for creating reports about the performance of the organization and fund.read moreMeghana PanditIndependent DirectorMeghana Pandit holds a bachelor’s degree in commerce and a master’s degree in management studies from the University of Mumbai, has cleared all three levels of CFA, CFA Institute (US) and a postgraduate diploma in financial analysis from the Institute of Chartered Financial Analysts of India. She is currently the Chief Investment Officer at IndiGrid. Meghana Pandit has over 21 years of experience in investment banking and corporate finance, covering the infrastructure sector across private equity transactions, mergers and acquisitions, initial public offerings, qualified institutional placements and infrastructure investment trusts, in sub-sectors such as roads, airports, renewable power, thermal power, ports and real estate. She has previously worked at IDFC Bank, Deloitte Financial Advisory Services India Private Limited and Essar Steel Limited.read moreArpito MukerjiIndependent DirectorArpito Mukerji holds a MBA from the University of Colorado and a master’s in Commerce from Himachal Pradesh University. He is a seasoned investment and banking professional, currently operating as an independent investor and advisor, focused on real estate opportunities in India. He has over 30 years of private equity, private credit and banking experience having led and managed deep value and distressed investments across asset classes and key geographies. He was most recently Managing Director at Apollo Global Management’s Asia Real Estate Group where he was part of the founding investment team in India since 2015. Before joining Apollo, Arpito was a Partner at Rezone Investment Advisors, a boutique India-focused Real Estate Advisory and Investment firm. Prior assignments have been with marquee firms like Bank of America Merrill Lynch, UBS, Dell Corporation, GE Capital and ABN AMRO Bank. read moreSaloni DoshiHead of StrategySaloni Doshi is the Chief of Staff and leads the strategy team at Strata. She is a Chartered Accountant and holds an MBA in finance and strategy from ISB, equipping her with a solid foundation in both financial acumen and strategic leadership. Saloni has over 12 years of general management experience across business development, planning and budgeting, financial controls, with expertise in integration, and turnaround strategies across manufacturing and. Bank of America Private Bank, Bank of America Private Wealth Management operates through Bank of America, N.A, and other subsidiaries of Bank of America Bank of America Private Bank. If you have over $3 million in investable assets, Bank of America Private Bank is another great option to consider. Bank of America offers exclusive products for its private bankingLogin - Bank of America Private Bank

Made with a debit card, Zelle and digital banking.Minimum opening deposit: $25Bank of America Advantage SafeBalance Banking FeesThe SafeBalance Banking account has a monthly maintenance fee of $4.95 that is waived for account owners under age 25 and customers enrolled in Bank of America’s Preferred Rewards program. It’s also waived if you maintain an account balance of at least $500.BofA charges no ATM fees for withdrawals from one of its approximately 15,000 ATMs. Using an ATM outside of Bank of America’s network in the U.S. results in a $2.50 charge for each ATM withdrawal — plus any fees charged by the ATM owner. 2. Bank of America Advantage Plus The Advantage Plus checking account offered by Bank of America includes more standard features than the SafeBalance banking account. Purchases can be paid by debit card, Zelle, mobile and online banking or checks.In addition, an overdraft protection transfer feature can be added to the Advantage Plus account, which automatically transfers funds from a linked savings account or checking account to cover purchases.Minimum opening deposit: $100Bank of America Advantage Plus FeesA $12 monthly fee applies to the Advantage Plus account, but it can be waived if you:Maintain a $1,500 minimum daily balanceHave at least one eligible direct deposit of at least $250Enroll in BofA’s Preferred Rewards programCash withdrawals are free at Bank of America ATMs, but you’ll have to pay a $2.50 fee for using an out-of-network ATM, plus any fees charged by the ATM operator.The account has a $10 overdraft fee,Comments

Group Editor February 18, 2025 The move represents a number of developments across BoA's wealth management and private banking arm in recent months. Bank of America Private Bank has appointed Mike Marino as Georgia market executive. Previously, he worked at JP Morgan Private Bank, where he was vice chairman of its South Atlantic region. Marino is on garden leave and will join BoA in late April, this publication understands. In total, Marino has more than three decades’ industry experience, working in private banking and investment banking. He holds a BA from Vanderbilt University and an MBA from Emory University. Marino has held leadership positions for educational organizations including the Emory University Advisory Board, finance committee chair for Atlanta Speech School, and The Posse Foundation Board. Marino serves as a board member for the Capital City Club as well as the Purpose Built Communities organization. See here for the latest financial results at Bank of America. In January, BoA's Merrill Wealth Management launched its new UHNW Advisory Group. In November, Bank of America Private Bank added a team of former Citi Private Bank figures in Palm Beach, Florida.

2025-04-16Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset allocation, rebalancing and diversification do not guarantee against risk in broadly declining markets.Neither Bank of America Private Bank nor any of its affiliates or advisors provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.Credit and collateral subject to approval. Terms and conditions apply. Programs, rates, terms and conditions subject to change without notice.Trust, fiduciary and investment management services, including assets managed by the Specialty Asset Management team, are provided by Bank of America, N.A., Member FDIC and wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”), and its agents.Bank of America Private Bank is a division of Bank of America, N.A.U.S. Trust Company of Delaware is a wholly owned subsidiary of Bank of America Corporation.p>Investment products:Are Not FDIC Insured Are Not Bank Guaranteed May Lose ValueBank of America, N.A., and U.S. Trust Company of Delaware (collectively the “Bank”) do not serve in a fiduciary capacity with respect to all products or services. Fiduciary standards or fiduciary duties do not apply, for example, when the Bank is offering or providing credit solutions, banking, custody or brokerage products/services or referrals to other affiliates of the Bank.

2025-04-14Share in account privilegesSuccession: UnlimitedPrivate foundation offering: Foundation management services6Client type: May be ideal for philanthropists who prioritize flexibility and controlTax preparation: Available to foundations provided our firm manages all assetsAdministration: Broad range of administrative services availableAccount minimums: Greater than $5 million is recommended, with no strict minimumsAssets accepted:CashSecurities and mutual fundsRestricted stock and closely held business interests4Hedge funds and private equity interest4Real estate, timberland, farms and ranches4Gas, oil and mineral rights4Certain other nonfinancial tangible assets4Other complex assets4Support from grantmaking professionals: Comprehensive support including strategic planning, grantmaking and administrative services, mission development, governance and compliance5Family involvement: Family members and other trusted advisors may be involved in roles such as trustee, director or advisorSuccession: UnlimitedFor donor-advised fund questions contact the Charitable Gift Fund at 888-703-3436 or email us at [email protected] private foundation questions or general philanthropic solution inquiries, email us at [email protected]. Learn more about strategic philanthropy & grantmaking Explore more insights 1 This limitation was increased from 50% to 60% for years 2018 through 2025, if all gifts are made in cash. It is scheduled to “sunset” and return to 50% in 2026. 2 Fair market value deductions generally subject to one-year holding period.3 Income received from investment assets (before taxes) such as bonds, stocks, mutual funds, loans and other investments (less related expenses). 4 Please note: additional fees may apply to taking in and managing these assets.5 Custom philanthropic strategy services are available for giving vehicle accounts > $10MM and/or households with investment assets > $25MM.6 Additional fees may apply to some of these services.Donor-advised fund and private foundation management are provided by Bank of America Private Bank, a division of Bank of America N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation.Institutional Investments & Philanthropic Solutions (also referred to as “Philanthropic Solutions” or “II&PS”) is part of Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Trust, fiduciary, and investment management services are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A.

2025-04-01Transactions More Private?If privacy is a concern for you, there are ways to be more discreet about your transactions. These aren’t perfect solutions, but they might help you feel a little more secure about your financial privacy.1. Use a Separate Account or Prepaid CardOne common recommendation is to use a separate bank account or even a prepaid debit card for OnlyFans transactions. If you’re a subscriber, this is particularly useful because you can keep these transactions away from your main banking activities. Prepaid cards, often found at local retail stores, can be loaded with a specific amount of money and used for OnlyFans purchases.Not only does this help keep your main account private, but it also adds an extra layer of security in case your OnlyFans account is compromised.2. Look for Banks with Private Banking OptionsAnother option for those who want extra privacy is to use banks that offer private banking services. Private banking might sound exclusive, but some banks offer variations of this that include enhanced privacy features. This means that transaction histories can sometimes be issued as internal memos that do not disclose specific vendors like OnlyFans.Some major banks that offer these features include JPMorgan Chase, Bank of America, and Wells Fargo. This could be an excellent option if you’re a content creator who wants to keep OnlyFans-related income discreet.3. Digital WalletsDigital wallets like PayPal are often an alternative method to make online transactions more discreet, but it’s important to note that OnlyFans does not directly support payments through PayPal at this time. However, some users opt for other payment intermediaries to make purchases indirectly. Keep in mind, this requires a few additional steps and may not always work seamlessly.User Experiences: How Others Have Dealt with ThisIf you’ve searched forums or community pages like Reddit or What to

2025-04-18Credit Cards Activating Your Credit Card Activate Your Credit Card Activating your credit card online is quick, easy and secure. We'll confirm your identity, verify your card and get you on your way. Activate your Bank of America credit card online The quickest way to activate your personal credit card is with your Online Banking ID and Passcode. We'll confirm your identity, verify your card and get you on your way. If you don't use Online Banking yet, simply enroll to activate your credit card. Already using Online Banking? Sign in and save time. If you're already using Online Banking, simply sign in using your Online Banking ID and Passcode to speed up the activation process. Sign in to Online Banking Not yet enrolled in Online Banking? Enroll now, then activate your card. If you're not currently enrolled in Online Banking, you can easily enroll, activate your card and conveniently manage your banking online. Enroll in Online Banking © 2024 Bank of America Corporation. All rights reserved. Bank of America, N.A. Member FDIC. Welcome to Online Banking, brought to you by Bank of America and Save time managing your finances, so you can spend more time living your life: View your statements online Receive Alerts on your account via email or mobile device Pay your credit card bill online Check your balance and account activity from your laptop or mobile device Welcome to Online Banking from Bank of America and . As an Online & Mobile Banking customer, you can:

2025-04-24